The first time home buyers tax credit was first introduced in 2009 and is available to all qualifying. The home is considered to be acquired once it is registered in your name in accordance with the land registration system or other similar system applicable where it is located in canada.

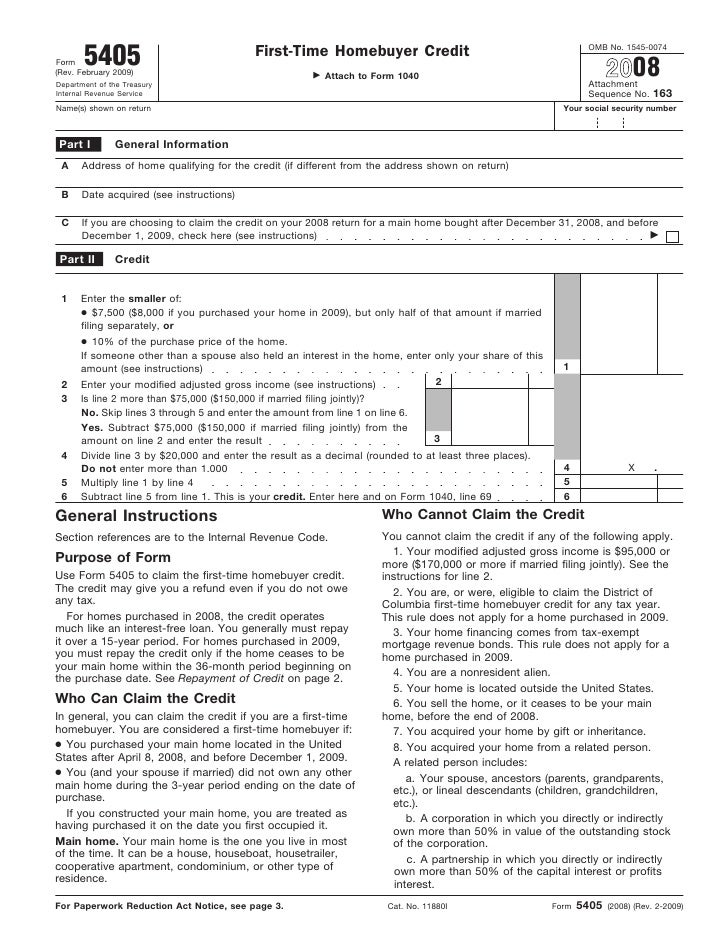

2008 First Time Home Buyer Irs Tax Form

2008 First Time Home Buyer Irs Tax Form

how to apply for first time home buyer tax credit

how to apply for first time home buyer tax credit is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to apply for first time home buyer tax credit content depends on the source site. We hope you do not use it for commercial purposes.

Repayment of the credit.

How to apply for first time home buyer tax credit. Simply put it offered home buyers a significant tax credit for the year in which they purchased their home. If you have a disability and are purchasing a home you do not need to be a first time home buyer to claim the home buyers tax cedit where a person with a disability is defined as a person who can claim a disability amount on their tax return in the year the home is purchased. To claim this tax credit on your saskatchewan income tax return use form sk428 available from the canada revenue agency.

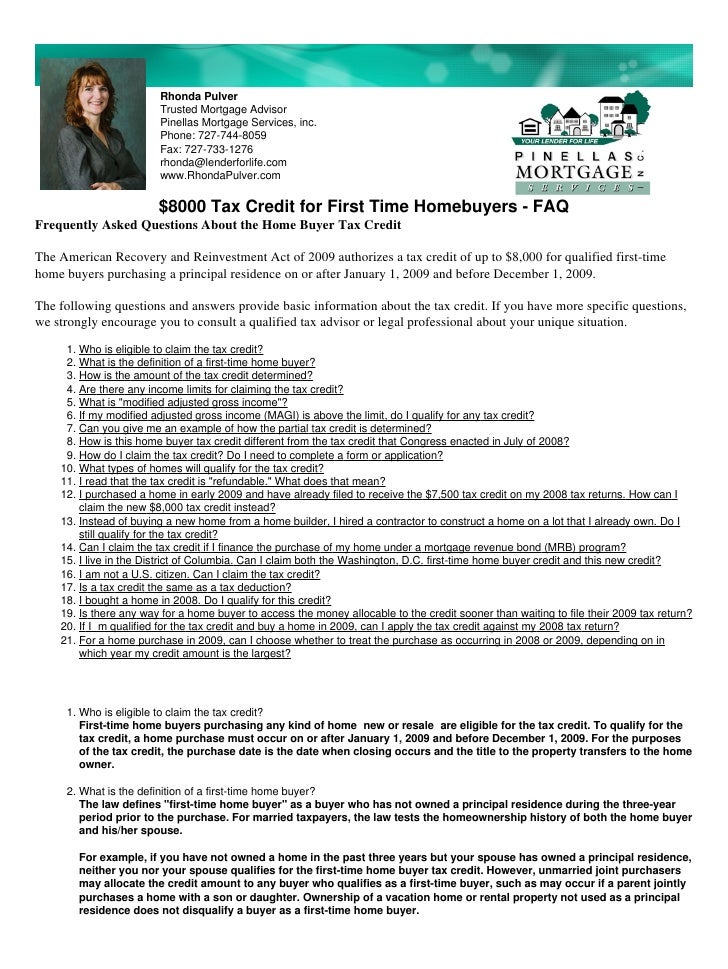

General repayment rules for 2008 purchases. The first time home buyer tax credit emerged during the 2008 financial crisis to help make buying a home more affordable for americans. The first time home buyer tax credit.

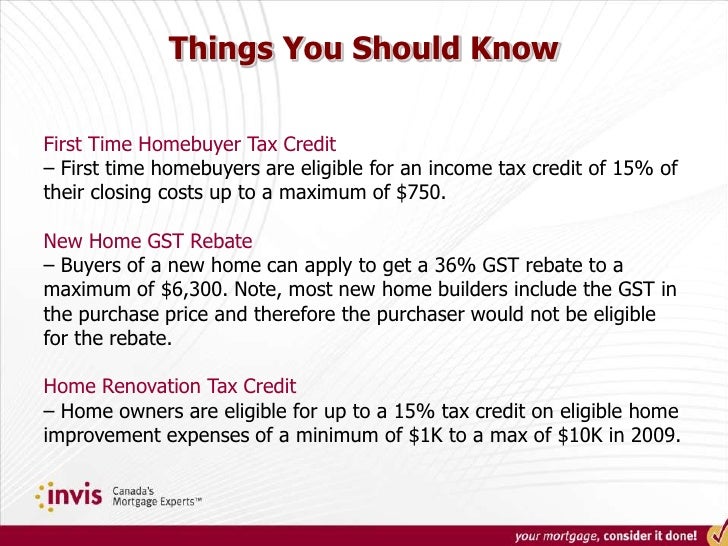

The first time homebuyers tax credit is a provincial non refundable income tax credit of up to 1050 to eligible taxpayers on qualified homes. If you buy a property with friends your spouse or anyone else you can all potentially claim the credit as long as everyone qualifies but the total claim amount can. A non refundable tax credit was enacted as part of the 2009 federal budget based on an amount of 5000 for first time home buyers who acquire a qualifying home after january 27 2009.

The home buyers tax credit hbtc is a non refundable credit that allows first time purchasers of homes and purchasers with disabilities to claim up to 5000 in the year when they purchase a home. If youve taken a leap into the real estate market you may be able to claim up to 5000 on your taxes. If youre buying a home for the first time claiming the first time home buyer credit can land you a total tax rebate of 750.

If you were allowed the first time homebuyer credit for a qualifying home purchase made between april 9 2008 and december 31 2008 you generally must repay the credit over 15 years. The federal first time home buyer tax credit is no longer available but many states offer tax credits you can use on your federal tax return. The home buyers tax credit has become the home buyers program.

While 750 isnt a life changing amount of money it can make buying your first home a little bit easier. Information for individuals about home buyers amount first time home buyers tax credit which reduces your federal tax. The first time home buyers tax credit hbtc is a non refundable tax credit that reduces the amount of taxes you owe.

Home buyers tax credit for people with disabilities. Line 31270 was line 369 before tax year 2019. Though various other mortgage programs and loans exist the tax provision here was strictly for first time home buyers.

Are You A First Time Home Buyer You Could Be Eligible For A Tax

Are You A First Time Home Buyer You Could Be Eligible For A Tax

Do I Have To Pay Back First Time Homebuyer Tax Credit Tax

Do I Have To Pay Back First Time Homebuyer Tax Credit Tax

All About The First Time Home Buyer S Tax Credit

All About The First Time Home Buyer S Tax Credit

First Time Homebuyer Presentation

First Time Homebuyer Presentation

First Time Home Buyer Tax Credit

First Time Home Buyer Tax Credit

First Time Home Buyer Tax Credit Down Payment

First Time Home Buyer Tax Credit Down Payment

Tax Credits Rebates For First Time Home Buyers In Toronto In

Tax Credits Rebates For First Time Home Buyers In Toronto In

Benefits Of The 2009 Tax Credit For First Time Home Buyers

Benefits Of The 2009 Tax Credit For First Time Home Buyers

The First Time Homebuyer Tax Credit Oppenheimer Co Inc

The First Time Homebuyer Tax Credit Oppenheimer Co Inc

Jackie Hogencamp The Murfreesboro Gazette Murfreesborogazette

Jackie Hogencamp The Murfreesboro Gazette Murfreesborogazette