If you rent your home you can deduct the part of the rent and any expenses you incur that relate to the workspace. To qualify for this business tax deduction for your home business you must meet certain basic requirements.

Home Office Expense Costs That Reduce Your Taxes

Home Office Expense Costs That Reduce Your Taxes

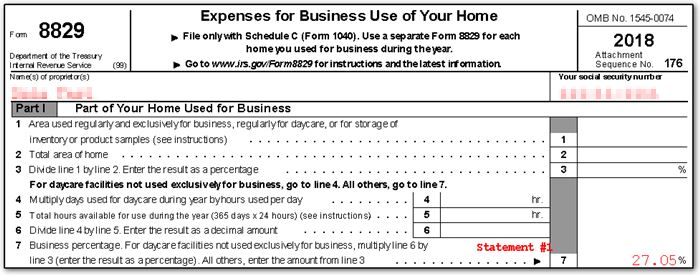

how to calculate expenses for business use of home

how to calculate expenses for business use of home is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to calculate expenses for business use of home content depends on the source site. We hope you do not use it for commercial purposes.

But the good news is that the expenses arent wasted.

How to calculate expenses for business use of home. Use a simpler calculation to work out income tax for your vehicle home and business premises expenses simplified expenses if youre self employed govuk skip to main content. If your business has had a rough year or youre just starting out its important to note that business use of home expenses cannot be used to create a business loss. Inland revenue sets the rates for calculating expenses.

This means you dont have to work out the proportion of personal and business use for your. Regular method you compute the business use of home deduction by dividing expenses of operating the home between personal and business use. Using your home for business.

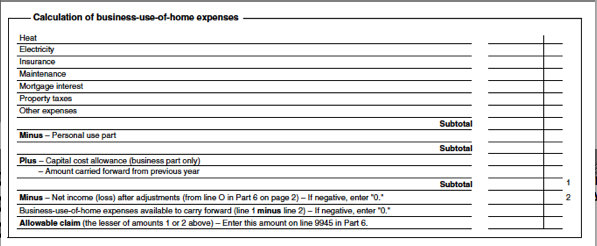

In other words your business use of home expenses cant be more than your business income. If you use part of your home for business you may be able to deduct expenses for the business use of your home. Calculation of business use of home expenses.

It excludes mortgage interest rates and rent. In other words you cannot use these expenses to increase or create a business loss. The home office deduction is available for homeowners and renters and applies to all types of homes.

This article explains these requirements shows you how to calculate the deduction percentage and explains the specific expenses you can deduct from your taxes if you qualify. You may deduct direct business expenses in full and may allocate the indirect total expenses of the home to the percentage of the home floor space used for business. The amount you can deduct for business use of home expenses cannot be more than your net income from the business before you deduct these expenses.

To calculate your business use of home expenses complete the calculation of business use of home expenses section on form t2125 part 7. There is a new way to calculate expenses like insurance and power based on the average cost of utilities per square metre of housing. Calculate your allowable expenses using a flat rate based on the hours you work from home each month.

The following is an example of how to calculate the business use of home expenses. The canada revenue agency cra has stringent conditions that determine whether a home business owner can claim business use of home expensesthe home office tax deduction.

Home Office Income Limitations Taxcpe

Home Office Income Limitations Taxcpe

Part 2 How To Prepare Business Taxes For Self Employed

Claiming Home Office Expenses Tax Deduction Canadian Business

Claiming Home Office Expenses Tax Deduction Canadian Business

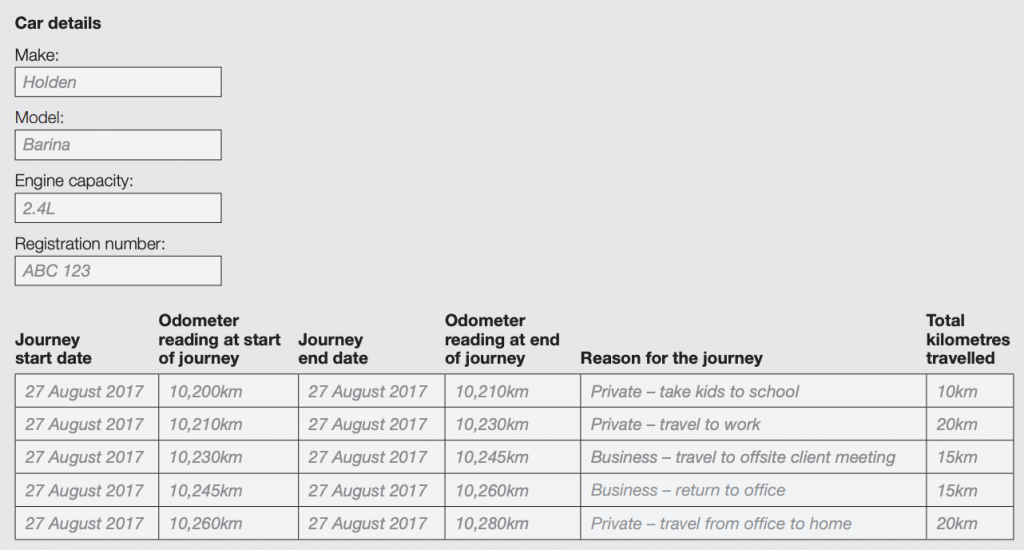

How To Calculate Your Car Expenses Ys Accounting

How To Calculate Your Car Expenses Ys Accounting

/a-guide-to-fixed-and-variable-costs-of-doing-business-393479_FINAL2-efbe65d5befe4d3bbe896f2376c755f9.png) Fixed And Variable Costs When Starting A Business

Fixed And Variable Costs When Starting A Business

Infographic How Do I Calculate My Working From Home Expenses For

Infographic How Do I Calculate My Working From Home Expenses For

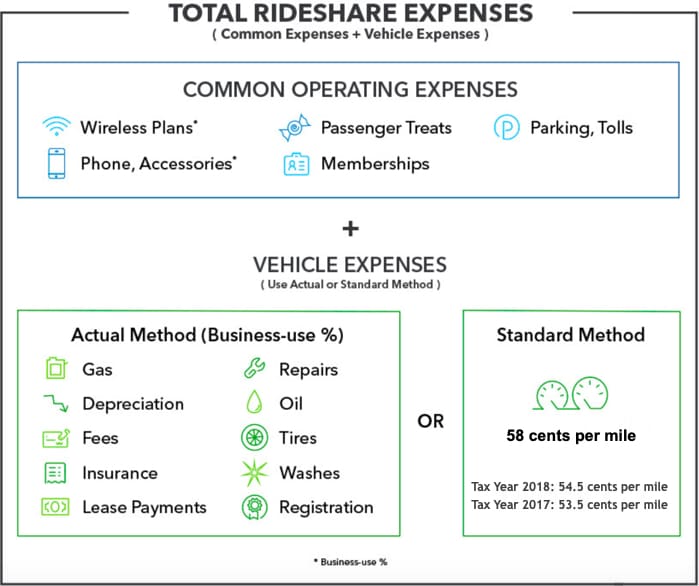

Standard Mileage Vs Actual Expenses Getting The Biggest Tax

Standard Mileage Vs Actual Expenses Getting The Biggest Tax

Taking A Home Office Deduction The Amboy Guardian

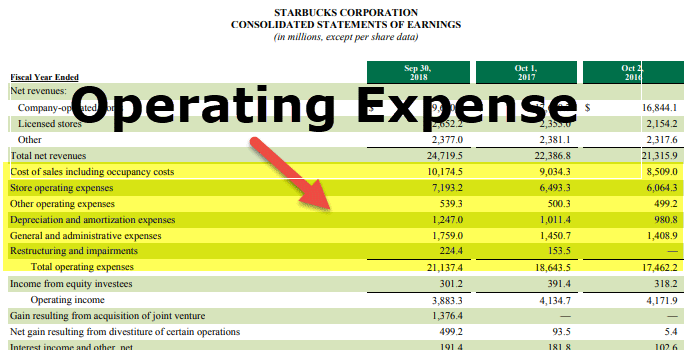

Operating Expense Definition Formula Calculate Opex

Operating Expense Definition Formula Calculate Opex

Infographic How Do I Calculate My Working From Home Expenses For

Infographic How Do I Calculate My Working From Home Expenses For