Posted on november 10 2017 by admin. The tax is payable on gains above a threshold the annual exempt amount which in 201718 is set at 11300 for individuals and 5650 for trusts.

How To Avoid Capital Gains Taxes When Selling Your House 2020

How To Avoid Capital Gains Taxes When Selling Your House 2020

how to avoid capital gains tax on second homes 2017

how to avoid capital gains tax on second homes 2017 is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to avoid capital gains tax on second homes 2017 content depends on the source site. We hope you do not use it for commercial purposes.

Many countries including the us the uk canada and australia assess capital gains taxes on any profit you make from the sale of a home.

How to avoid capital gains tax on second homes 2017. Residents must meet all criteria to avoid the capital gains tax on a property sale. Funds second homes or buy to let properties business premises. A second home and capital gain tax rules.

How to avoid capital gains tax on second homes. You generally wont need to pay the tax when selling your main home. If you sell a property in the uk you may need to pay capital gains tax cgt on the profits you make.

Capital gains tax cgt is a complex area to dip into so here ive tried to give a brief. When it comes to capital gains taxes the internal revenue service draws a hard line between homes used as principal residences and investment properties. Capital gains tax is scooping up more taxpayers in its net.

Do i pay capital gains tax on property. While the sale of your primary residence typically. Avoiding capital gains tax on a property sale.

The uk defines a few scenarios that make avoiding capital gains tax on a property sale possible. If youre thinking about buying a second home for vacations rental income or an eventual retirement residence it makes financial sense to take advantage of all the available tax breaksthe. Making sense of capital gains tax and your property 2017 2018.

This is primarily the case when a resident sells their home. However you will usually face a cgt bill when selling a buy to let property or second home.

:max_bytes(150000):strip_icc()/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81.png) The Home Sales Exclusion From Capital Gains Tax

The Home Sales Exclusion From Capital Gains Tax

How To Avoid Capital Gains Tax When Selling Property Finder Uk

How To Avoid Capital Gains Tax When Selling Property Finder Uk

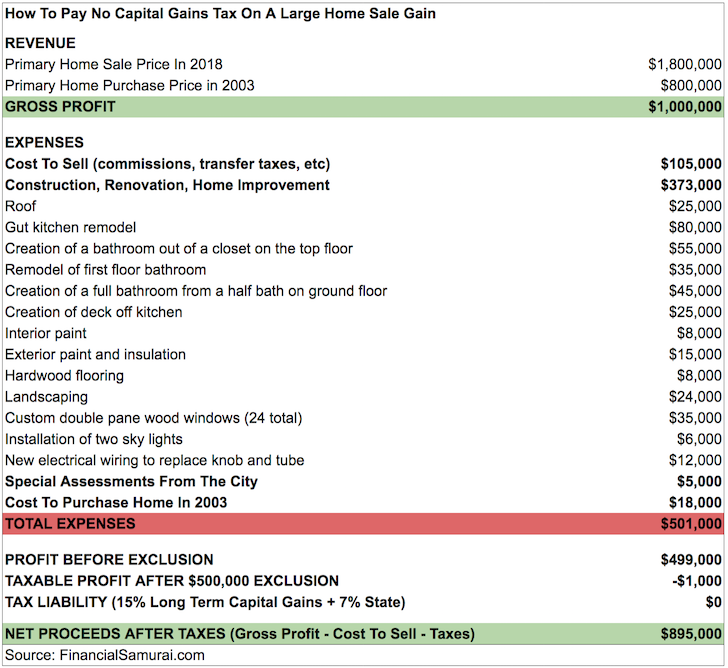

How To Pay No Capital Gains Tax After Selling Your House For Big

How To Pay No Capital Gains Tax After Selling Your House For Big

Will You Pay Capital Gains Taxes On A Second Home Sale Millionacres

Will You Pay Capital Gains Taxes On A Second Home Sale Millionacres

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Real Estate 101 How Rental Properties Are Taxed Millionacres

Real Estate 101 How Rental Properties Are Taxed Millionacres

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block

Tax Law For Selling Real Estate Turbotax Tax Tips Videos

Tax Law For Selling Real Estate Turbotax Tax Tips Videos

Tax Breaks For Second Home Owners

Tax Breaks For Second Home Owners

How To Avoid Capital Gains Tax When Selling Property Finder Com

How To Avoid Capital Gains Tax When Selling Property Finder Com

How To Buy A Second Home Bankrate Com

How To Buy A Second Home Bankrate Com