Real estate taxes are deductible. A persons gross total income chargeable to tax is a sum of income under various heads such as income from salary income from other sources etc.

Home Loan Emi And Tax Deduction On It Emi Calculator

Home Loan Emi And Tax Deduction On It Emi Calculator

how to calculate tax rebate on home loan

how to calculate tax rebate on home loan is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to calculate tax rebate on home loan content depends on the source site. We hope you do not use it for commercial purposes.

The tax benefits on principal repayment are limited to section 80c.

How to calculate tax rebate on home loan. Submit your home loan interest certificate to your employer to adjust the tax deductible at source. Your home loan can also help you to save taxes on your income. Thus this tax saving calculator will help you in calculating the benefit that you can claim in the income tax by buying a home.

The type and amount of income tax deduction available against repayment of home loan is governed by applicable income tax laws of government of india. You may claim deductions in your income tax against principal and interest payments that you make towards repayment of your home loans. Calculate the tax deduction to be claimed.

Every principal and interest payment made against your home loan can be claimed for deductions in your income tax. Tax deductions are significantly less in those cases as the point credit is spread out over the life of the loan instead of in one lump sum as with a first mortgage. However there are additional tax benefits for home loan interest payment provided you meet certain conditions.

Save tax on your income by taking a home loan. You get an additional tax deduction of upto rs 50000 per annum for home loan interest payment provided. Claiming tax benefits on home loan is a simple process.

Part of home ownership is paying real property tax on your asset. This is also important for tax saving if you want to set off the interest you are paying on any home loan taken for the same house against the income from house property. Below are the steps to claim your tax deduction.

There are different tax rules for a refinance or a line of equity loan. Ensure that the house is in your name or you are the co borrower of the loan.

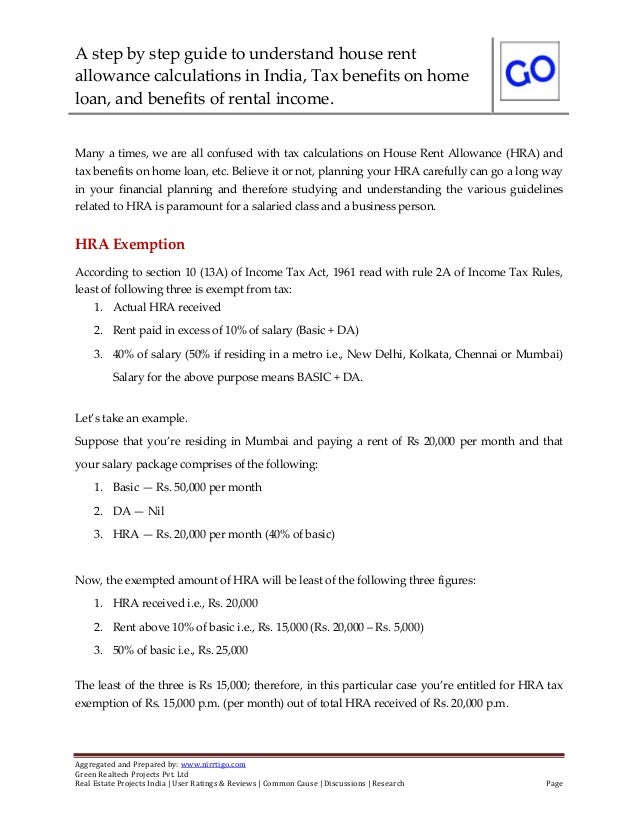

House Rent Allowance Calculations And How To Calculate Tax Benefits O

House Rent Allowance Calculations And How To Calculate Tax Benefits O

Tips To Use All The Tax Benefits That Are Available On Home

Tips To Use All The Tax Benefits That Are Available On Home

Home Loan Calculator To Pick Up Tax Benefits

Home Loan Calculator To Pick Up Tax Benefits

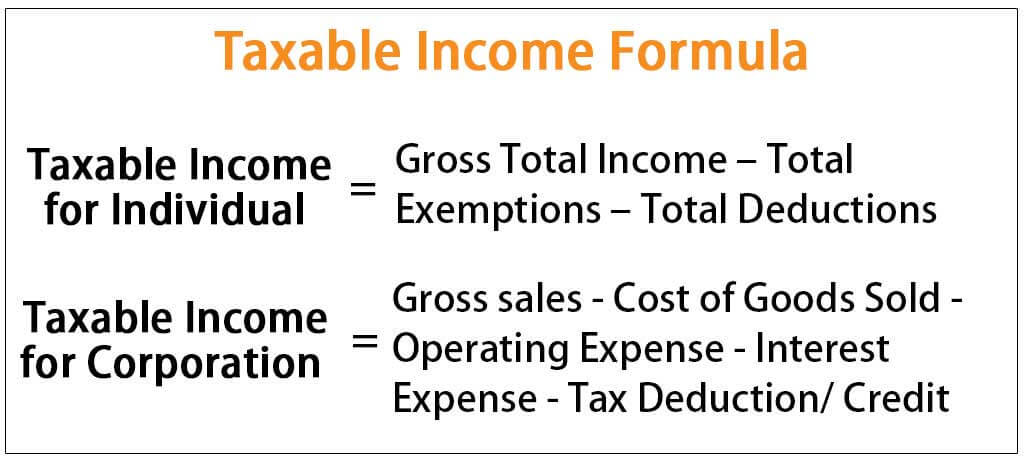

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Tax Benefit For Home Loan The Borrowers Benefit Finance

Tax Benefit For Home Loan The Borrowers Benefit Finance

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Calculate Your Mortgage Interest Deduction The Right Way

Calculate Your Mortgage Interest Deduction The Right Way

Use The Interactive House Loan Emi Calculator To Calculate Your

Use The Interactive House Loan Emi Calculator To Calculate Your

/calculate-loan-interest-315532-Final-5c58592346e0fb000164daf0.png) Compute Loan Interest With Calculators Or Templates

Compute Loan Interest With Calculators Or Templates

Properly Understand The Tax Benefits On Your Housing Loan Scoop